Remove unproductive time from KYB onboarding

Your team spends less time finding, chasing, and reconciling data, and more time making decisions, even on complex cases.

Why Strise?

Complex casesmove in hours, not weeks

Low-risk customers onboard automatically

Reclaim 70% of analyst capacity

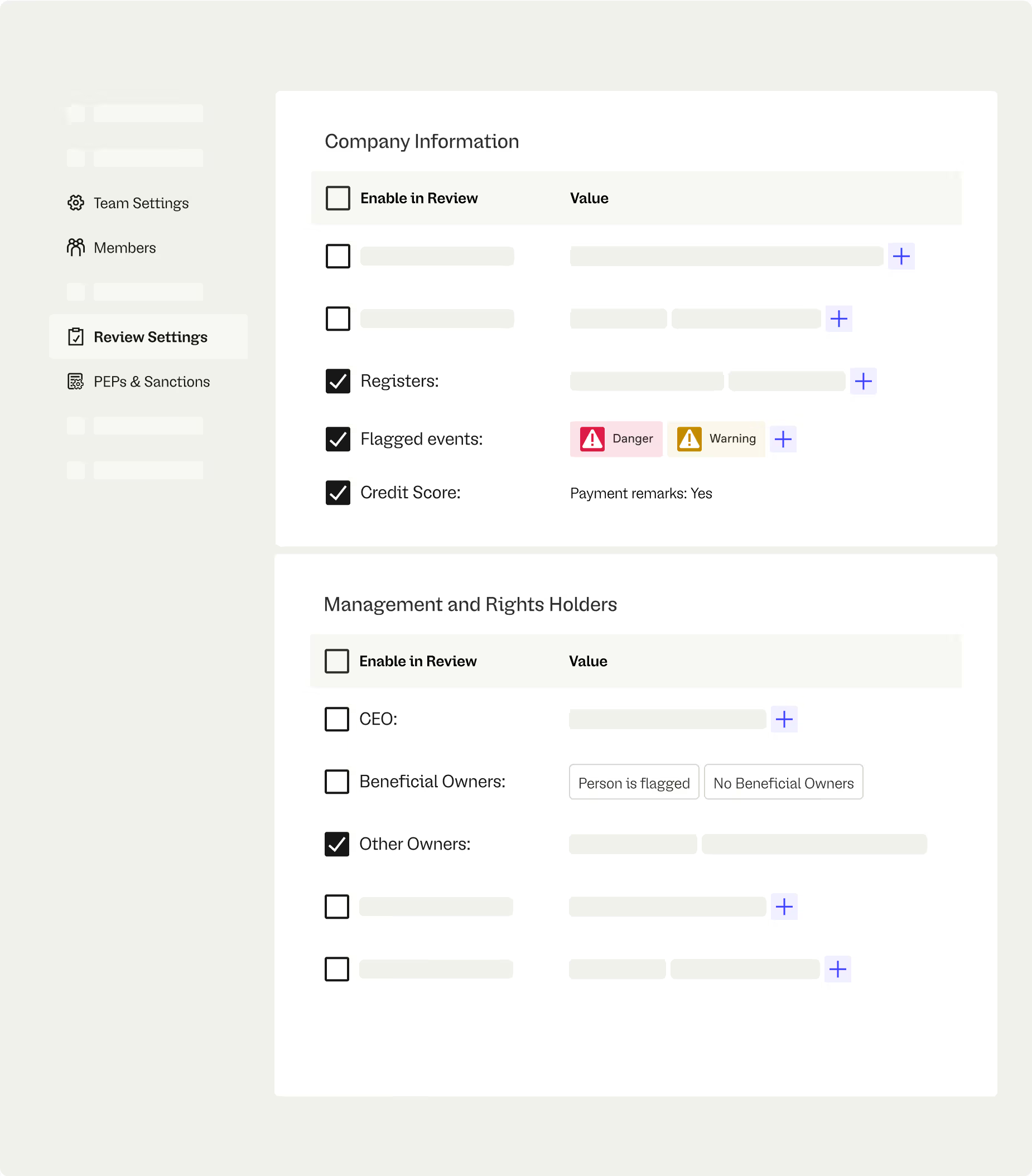

With Strise, you centralize KYC and KYB into one platform that pre-populates data, automates identity and business checks, and uncovers complex ownership networks in one shot. You reduce manual searches, cut onboarding time by up to 90 %, and generate audit-proof reports at the click of a button.

Strise can be integrated through its SaaS platform and APIs, facilitating seamless interaction with its data layer for various AML processes.

For a regulated company to effectively tackle AML, it is essential to address two critical aspects: the 'data problem' and the 'workflow problem.'

Strise is unique in addressing both in a single system. It offers an end-to-end AML Automation Cloud that addresses both the data and workflow problems, and by doing so, Strise contributes to a more streamlined, effective, and error-free AML process for regulated companies.

The 'data problem' involves collecting and validating real-time customer data during the different AML stages and reducing the number of false positives. Many competitors offer this data but fail at providing an excellent workflow that brings together this data. This gap often forces regulated companies to rely on different systems from several providers, complicating the KYC/KYB and AML processes and making them error-prone.

On the other hand, the 'workflow problem' relates to automating and optimising the task flow for front-line workers in regulated companies. While some competitors tackle this workflow and accompanying case management, they often fail to address real-time data collection issues efficiently.

The results of our unique approach speak for themselves. Strise customers report 90% faster customer due diligence and software cost reductions of up to 30%, reflecting the efficiency and ease of the Strise system.

It's evident that solving the data problem greatly optimises workflow and vice versa.

Our advanced graph models help Strise map real-world relationships between people, businesses, locations, and other important factors. By understanding these connections, Strise creates a dynamic, evolving picture that continuously updates with the most crucial information. This gives you a comprehensive view, allowing you to make more informed and effective decisions when assessing customer risk or verifying customers.

Yes, Strise automatically puts PEP checks into a workflow, driving higher levels of compliance with more data on who to check while simplifying a manual process with potential for human error.

PEPs are just one of many regulatory required sources that Strise organises into your customer portfolio, giving the most holistic view across all required information at all times.

Yes, Strise gives an instant and complete overview of owners and the risks associated with each person and their network provides a revolutionary understanding compared to single company and people searches.

Strise automatically calculates ownership and voting power even in complex structures to list all UBOs and alternative UBOs.

Yes, with Strise all teams have access to updated credit scores, collateral, payment remarks, and key financials at any given time, creating one source of truth for everyone.

Yes, Strise has the industry's most comprehensive Adverse Media Screening. With real-time information from 250.000+ sources, Strise allows you to control and prioritize what's most important to see about your customers at any time.

Strise solves both use cases. KYC (Know Your Customer) and KYB (Know Your Business)

Strise allows your team to add entities and override a company’s ownership structures based on new information from your customer.

This way, your team can easily manage entities that are one or more steps removed from your customers and could be dangerous from a risk and sanctions perspective.

Yes, we incorporate sanctions data directly from the U.S. Consolidated Screening List (OFAC, BIS, State) and UK, EU, and UN sanctions lists.

We have further enriched this data to map the ownership and control relationships so you can comply with OFAC’s 50% rule.

Hello, AML automation

AML backlogs persist because data is fragmented, duplicated, and hard to trust. Strise uses AI to resolve and enrich AML data into a single, living customer record that stays consistent across onboarding, monitoring, and investigations. With trusted, resolved data as the foundation, automation scales. Analysts focus on risk, not reconciliation. Compliance becomes faster, explainable, and ready for change.