Goodbye, cost centre Hello, AML automation

SEEYA

Turn AML from a manual burden to an automated winner

Strise named one of the world’s most innovative companies of 2024 -

We're one of the world's most innovative companies

Read the listAML, supercharged

Up to 90% faster

due diligence with Strise

Customers report cutting due diligence time from 1 hour to 10 minutes

Cut costs by 30%

in software spend alone

Customers report going from 4+ providers to having it all in Strise

30%+ reduction

in false positives

Strise clients cut false positive rates with enhanced customer risk insights

Start your new AML journey

Faster onboarding and

audit-proof reports

Get the full picture of your customers, reduce client outreach, and speed up onboarding while replacing multiple searches.

Strise automatically collects all the insights your team needs and documents everything into a finished and audit-proof report.

Strise automatically collects all the insights your team needs and documents everything into a finished and audit-proof report.

Strise saves us a considerable amount of time per customer onboarding.

Mitigate customers' hidden network risks

Strise unveils hidden risks in your customer network by utilising advanced AI and graph models.

Intricate connections and risky patterns are revealed and highlighted by connecting relationships across millions of entities.

Intricate connections and risky patterns are revealed and highlighted by connecting relationships across millions of entities.

With Strise, we enhance our TM and detect suspicious transactions before they even happen.

Stay compliant with perpetual monitoring

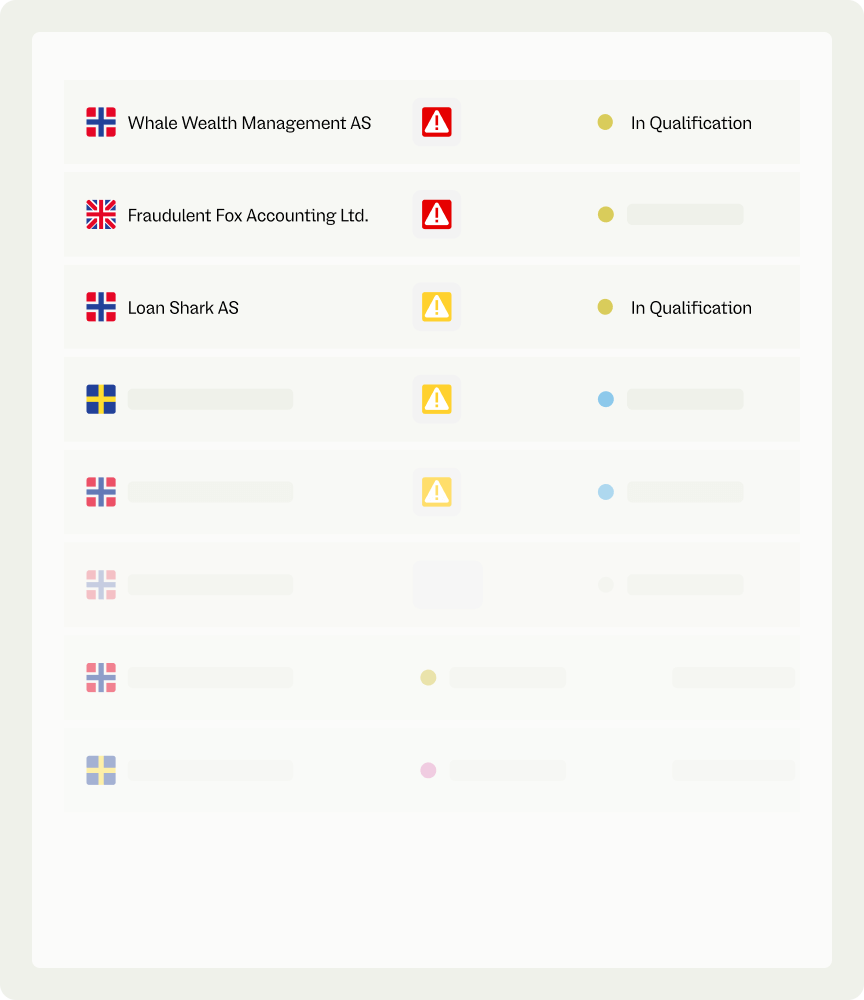

Strise simplifies ongoing customer due diligence (pKYC/pKYB) by automatically monitoring essential changes in customer profiles.

It assesses the risk level of each case, swiftly addresses low-risk situations, and concentrates on high-risk scenarios for a more thorough examination.

It assesses the risk level of each case, swiftly addresses low-risk situations, and concentrates on high-risk scenarios for a more thorough examination.

With Strise we get a single source of truth and better information about our customers, which makes us a better bank.

Secure, auditable, and explainable

Strise offers a secure, SOC 2 certified environment, featuring auditable AI models and rules. We ensure data protection, GDPR compliance, and safe user experiences.

Visit our security and trust center

Don’t just take our word for it

Explore solutions

Strise Case

Augmented KYC and KYB that replace 50+ manual searches with pre-populated checklists for secure and efficient case handling.

Explore Strise Case

You are already here

Strise Control

Experience peace of mind with Strise's real-time, continuous monitoring and ongoing customer due diligence.

Explore Strise Control

You are already here

Strise Automate

Automate your end-to-end AML processes with intelligent APIs or enhance your business operations with unparalleled insights.

Explore Strise Automate

You are already here

.png)